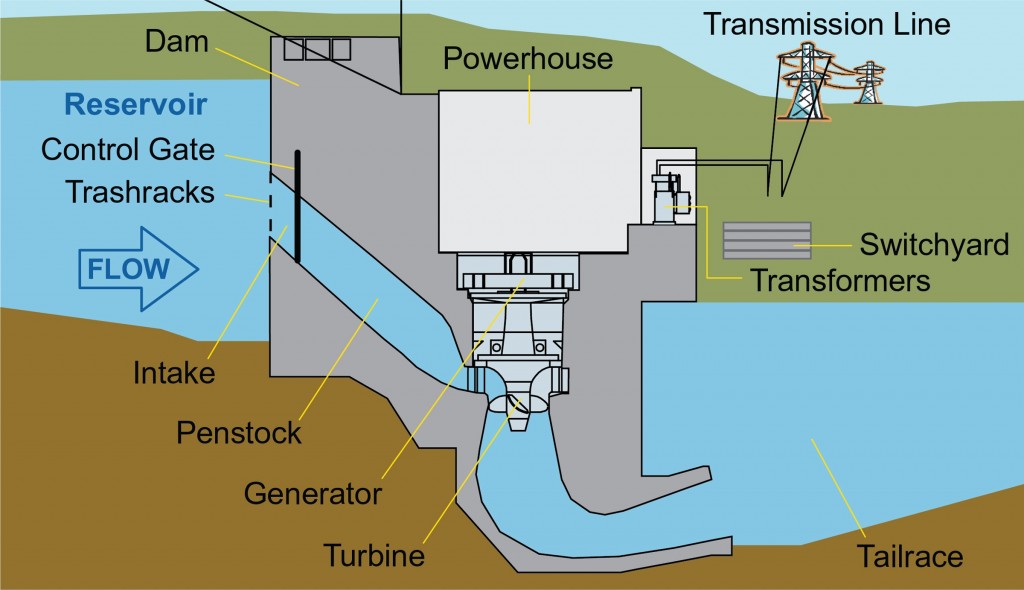

Taxable price of natural water used for hydroelectricity generation

On October 28,2016, the Ministry of Finance issued the Circular No. 174/2016/TT-BTC on amending and supplementing point a Clause 4 Article 6 of Circular No. 152/2015/TT-BTC dated October 02, 2015 by the Ministry of Finance providing guidance on resource royalty. Accordingly, from December 12, 2016, taxable price of natural water used for hydroelectricity generation is […]

Should the gov’t tax second homes?

While Việt Nam’s Finance Ministry writes a proposal to tax second homes, the Việt Nam News asked our readers to share their thoughts on a potential multiple-home tax. Here are some of the responses: Nguyễn Thanh Hà, Vietnamese lawyer, Hà Nội As far as I know, many countries tax multiple-house owners in order to develop […]

Foreign Contractor withholding and other legal advice for Foreign Investors

Question: I'm looking for some legal advice and possible legal retention on ongoing business I as a business consultant for an education firm in HCM City. I've recently run into some difficulty receiving payment for invoices due - banks have asked for tax id information, and I've given them my American IRS Employer Identification Number, but […]

New rate of corporate income tax in Vietnam

The Circular 141/2013/TT-BTC of Ministry of Commerce, which comes into effect from November 30, 2013, states that the companies established under Vietnam’s law, including cooperatives, public service agencies of which annual revenues does not exceed 20 billion VND shall enjoy corporate income tax rate of 20% from July 01, 2013. The new companies that are […]

Personal Income Tax in Vietnam

SBLaw would like to provide a brief of Personal Income Tax (PIT) in Vietnam for businessman’s reference: 1. Tax Residency Residents are those individuals meeting one of the following criteria: • residing in Vietnam for 183 days or more in either the calendar year or the period of 12 consecutive months from the date of […]

Taxes for importing of jewelry in Vietnam

What are the procedures for importing of jewelry items and what taxes are duties are to be paid in the course of importing? The Importer must work with the Vietnam Custom to get license for importation of jewelry items. Import Duty Rate generally is from 0-10%. Can precious metals and unprocessed gems be exported from […]